Recent Comments

- ZeitgeistWorker on Shitegeist

- RT Farty Kremlin Party | A Thousand Flowers on Shitegeist

- Javier Sobrino on Scotland and the Basque Country: the struggle for independence

- Gorbachev on Prostitution, the abolition of the victim and post-modernism's defence of the status-quo

- Andy Bowden on Class politics or anti-semitic conspiracies? Why David Icke, Ron Paul and Alex Jones are dangerous to the Occupy Movement.

Tags

afghanistan austerity britain BNP climate change Con Dem coalition demonstration drugs economy edinburgh education elections environment events evil megacorps fascism feminism fighting cuts glasgow greece health internet knobheads Labour Lib Dems moral panic music news police protest racism science SDL sexism sexuality SNP strikes tabloids Tories tv unemployment unions USA war women's rights workers' rightsArchives

- June 2012

- May 2012

- March 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

-

Authors

- admin

- And

- Andy Bowden

- Brogan

- CelticEwan

- David

- Erofeeva

- Euan Benzie

- Frenchie

- ImSpartacus

- Jack

- James McIntyre

- James N

- Kirsty Kane

- Liam M

- Liam T

- lovebug

- LydiaTeapot

- Meghan

- Muzza

- Neil B

- neldo

- Sarah

- Scottish Socialist Youth

- Snowball

- Socialist Pharmacist

- Sophie

- Squeak

- Stuart

- syebot

- TheWorstWitch

- Wavejumper

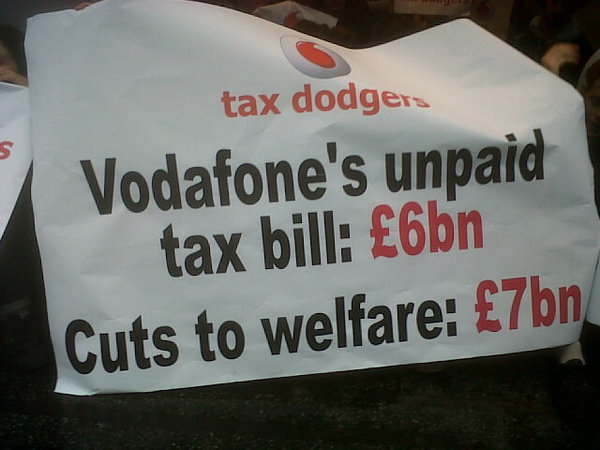

Vodafone store shut down by anti-cuts activists

Protesters today shut down Vodafone’s flagship shop in London, after it emerged that the government was going to let them dodge £6 billion in tax, just as it is taking £7 billion away from the poorest in the UK through benefit cuts.

Vodafone set up a subsidiary company in Luxembourg to try and avoid paying taxes on its profits at UK rates – its front was paying only 1%. This is against the laws relating to tax avoidance. But HM Revenue and Customs have decided to let them away with paying just £1.2 million to get off the hook, when its profits over the period affected by this tax dodge have been billions. Independent assesment reckons that it’s up to £6 billion lost to the people of the UK.

No surprises then that it was discovered that the head of tax at Vodafone is John Connors, who until 2007 was a top man at the HMRC and is mates with all the people responsible for negotiating to let his company off the hook. Yet again, the government is exposed as working hand in glove with their personal friends in big business, in a collective shafting of the rest of us.

In a future with no Skynet, John Connor(s) is reduced to helping Vodafone doge tax

Except this time, some people decided they weren’t just going to sit back and let it happen. Mobilising over the weekend through the UKuncut twitter, lots of different people got together and moved in this morning to blockade and occupy the Oxford Street store before it could serve a single customer. Vodafone were forced to shut the shop, and it remained closed all day while protesters were outside.

Now they’re calling for people to join them this Saturday by shutting down Vodafone shops across the UK. Whaddya think? Vodafone have kindly provided a facility for you to find your nearest potential protest site. Can Scotland join a wave of occupations against them this weekend? Like their slogan says, Make the Most of Now.

Does someone who has a twitter want to comment on the ukuncut thing and see if anyone else is thinking of doing something in Scotland?

I’ve put out a couple of messages.

Facebook event etc?

let’s do it.

halloween style

Can this be done in time for Saturday?

http://www.youandifilms.com/2010/10/vodafone-dodge-6bn-tax-bill-vodafoneuk-ukuncut/ – seem to recognise a couple of folk in there! although i don’t think your shoes were involved this time jack haha

Thanks liam, i added the video to the article.

in town and up for this..in a halloween mask

had no idea John Connor used to be in the HMRC but Im not surprised, the few doubts I had about this just flew out the window lets shut them down on Saturday.

and not that I doubt it but would you mind sending me the source for the fact he was in the HMRC I haven’t seen this information in any news reports on the subject.

Hi Chris, my original source for the Connors info is the This is Money website who have taken a lead role in breaking this story, and now seem a bit bemused to find themselves associated with a protest movement:

http://www.thisismoney.co.uk/news/article.html?in_article_id=514832&in_page_id=2

But there’s another article from the time of his appointment here:

http://www.accountancyage.com/accountancyage/news/2188106/top-taxman-ditches-civil

Ultimately the decision to let Vodafone off this bill rested with the HMRC permanent secretary for tax, Dave Hartnett, who Connors formerly worked very closely with. From the 2nd article: